Contract signings picked up the pace last month, and home buyers are increasingly facing multiple offer situations. NAR releases its housing forecast for the remainder of the year and 2024.

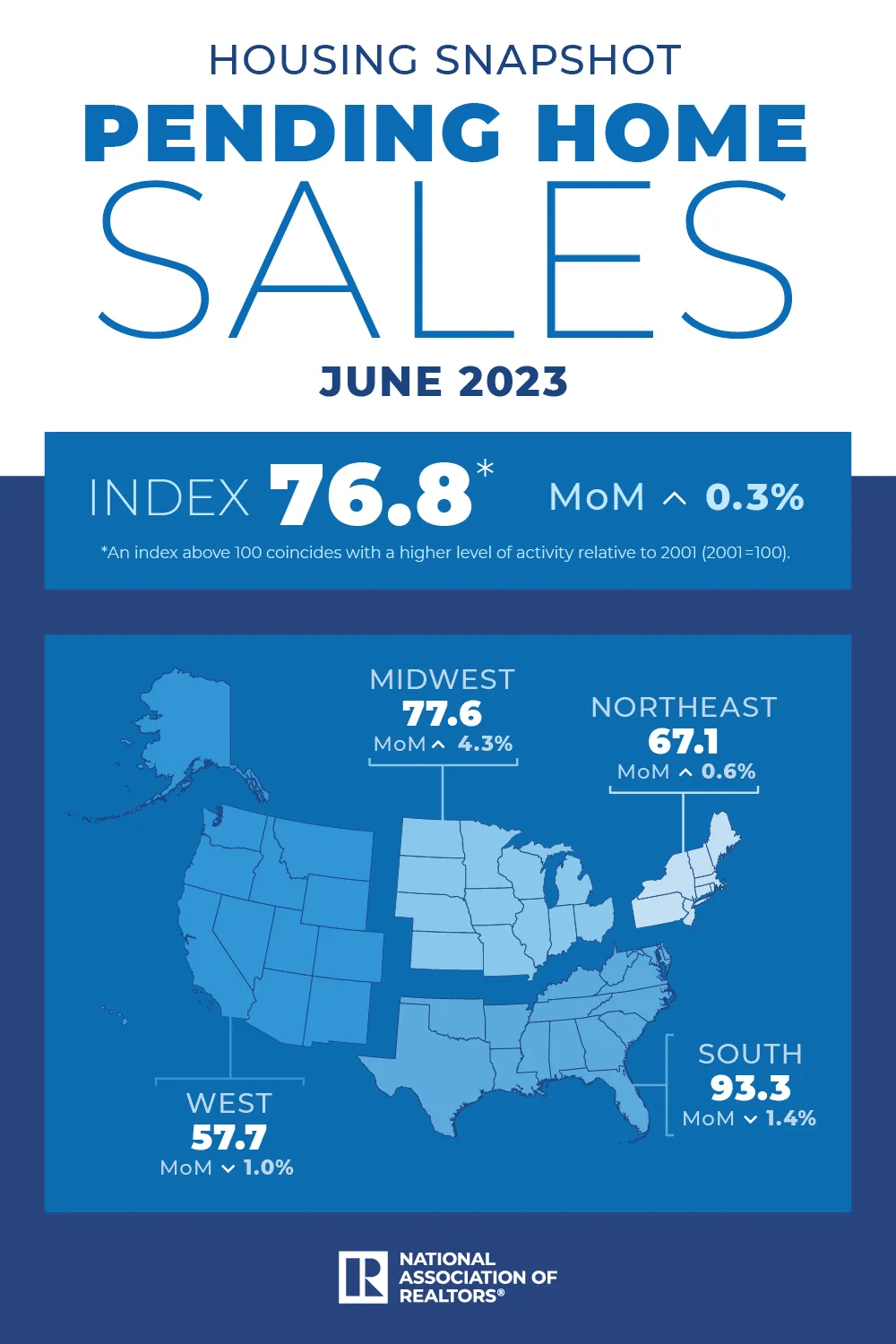

Pending home sales rose slightly in June, and the latest indicators are showing a housing market on the mend. Median existing-home sales prices in June soared to their second highest on record in the last two decades, and more buyers are facing multiple offer situations once again, the latest reports from the National Association of REALTORS® shows. NAR’s Pending Home Sales Index—a forward-looking indicator of home sales based on contract signings—rose 0.3% in June, the first increase in four months.

“The recovery has not taken place, but the housing recession is over,” says Lawrence Yun, NAR’s chief economist. “The presence of multiple offers implies that housing demand is not being satisfied due to a lack of supply. Homebuilders are ramping up production and hiring workers.”

Housing inventories remain at historical lows, down 13.6% from even last year’s low levels. “There are simply not enough homes for sale,” Yun said in a recent report. Seventy-six percent of existing homes sold in June were on the market for less than a month, NAR’s data shows.

Home buyers are faced with limited choices, higher home prices and higher mortgage rates. But they may find some relief soon: Mortgage rate increases may be mostly over, and that would bode well for home-buying, Yun says.

“With consumer price inflation calming close to the Federal Reserve’s desired conditions, mortgage rates look to have topped out,” Yun says. “Given the ongoing job additions, any meaningful decline in mortgage rates could lead to a rush of buyers later in the year and into the next.”

NAR forecasts that the 30-year fixed-rate mortgage could reach 6.4% by the end of the year, followed by 6% in 2024. Over recent weeks, mortgage rates have been nearing 7%, far from their ultra-low 2% or 3% averages just over a year ago.

Home Sales Outlook

NAR released its latest forecast showing what they believe will be the trajectory of the market over the coming months:

- Existing-home sales: NAR predicts existing-home sales to fall 12.9% in 2023 compared to 2022, and then climb by 15.5% in 2024.

- Prices: National median existing-home prices are expected to remain mostly steady, likely ending this year just 0.4% down compared to 2022, reaching $384,900 for 2023. Home prices are then expected to rebound by 2.6% in 2024 to $395,000, NAR predicts. The West—the nation’s priciest region—likely will see prices reduced more, while more affordable regions, like the Midwest, are forecasted to post moderate increases, NAR’s report says.

- New-home sales: Sales of newly constructed homes are forecasted to be a bright spot for home sales, as more buyers search for greater inventory options. New-home sales are expected to rise by 12.3% in 2023, and by another 13.9% in 2024, NAR predicts. The national median new-home price is expected to fall by 1.9% this year, to $449,100, before jumping by 4.2% the following year to $468,000.

- Housing construction: Economists have been calling on the new-home market to make up for the supply deficits in the real estate market. But NAR is forecasting that housing starts will fall 5.2% in 2023 compared to 2022 (reaching 1.47 million). Housing starts are expected to ramp up in 2024, however, rising 5.4% to 1.55 million.

“It is critical to expand supply as much as possible to widen access to home buying for more Americans,” Yun says. “Home prices will be influenced by how much inventory is brought to market. Increased homebuilding will tame price growth, while limited construction will lead to home price appreciation outpacing income growth.”

Regional Breakdown on Contract Signings

Meanwhile, the latest housing market conditions show a market much slower than last year’s brisk pandemic-fueled pace. Overall, pending home sales were down in June by 15.6% compared to last year, NAR’s data shows. But market performance did vary regionally. Month over month, contract signings increased in the Northeast and Midwest, while falling in the South and West. Nevertheless, all four major regions of the U.S. posted year-over-year decreases in transactions in June.

Source: NAR: Melissa Dittmann Tracey