A jump in pending home sales in January indicates consumers are wading back into the market as rates settle in the 6% range.

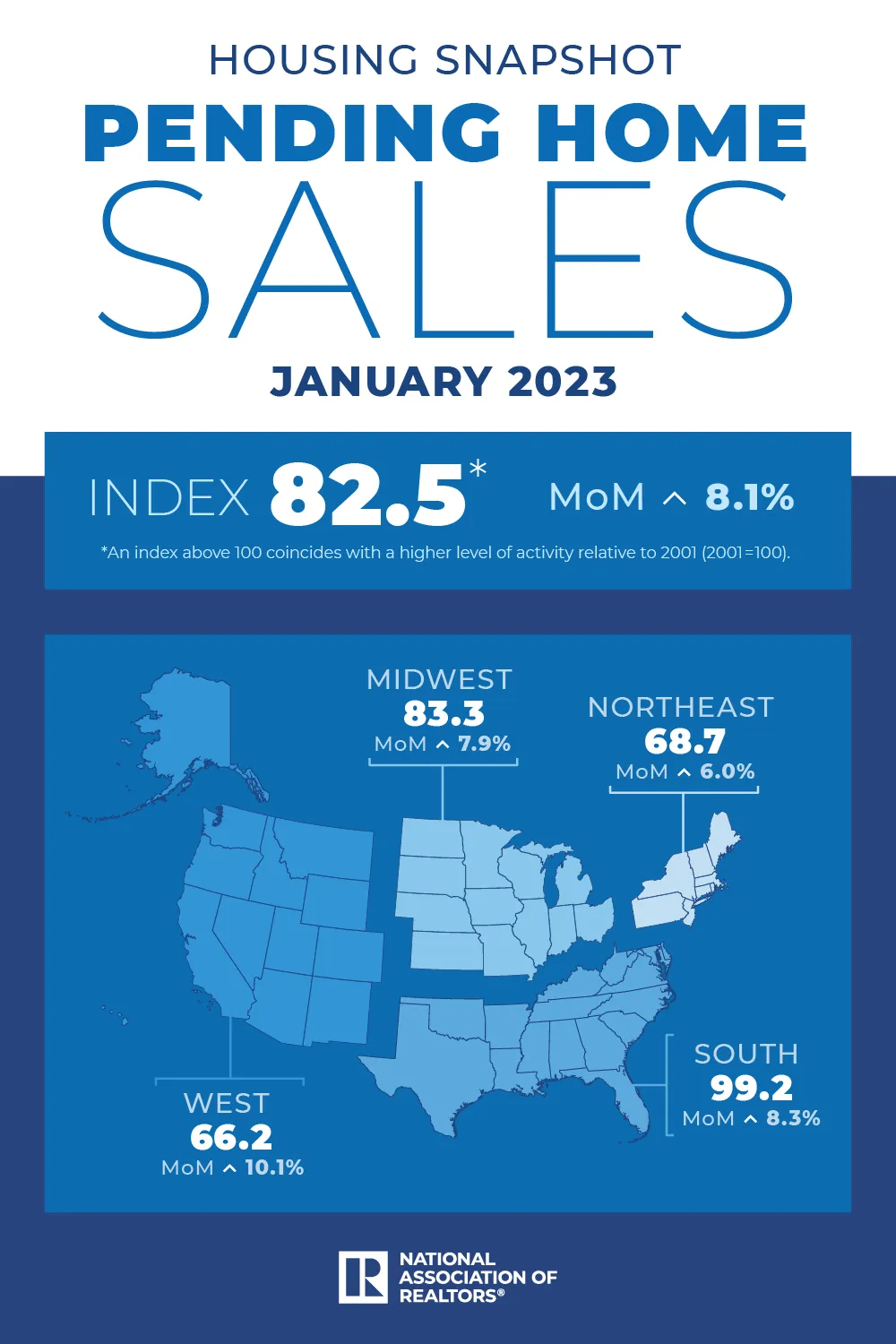

For the second consecutive month, contract signings increased in January, registering their largest month-to-month gain since June 2020, the National Association of REALTORS® reported Monday. NAR’s Pending Home Sales Index jumped 8.1% from December to January, showing that buyers are rushing to take advantage of recently falling mortgage rates. And in more positive housing news, sales of newly built single-family homes rose 7.2% last month, the Commerce Department reported separately.

Mortgage rates crossed the 7% threshold in November, reaching more than double a year prior and giving buyers sticker shock. But since the beginning of the year, the 30-year fixed-rate mortgage has dialed back to the 6% range—clocking in at 6.5% last week—with less volatile fluctuations. NAR is forecasting that mortgage rates will average 6.1% this year and 5.4% in 2024. “Buyers responded to better affordability from falling mortgage rates in December and January,” says NAR Chief Economist Lawrence Yun.

An improving interest rate environment, along with recent job gains, is prompting a better outlook for housing. Home sales activity appears to be “bottoming out” in the first quarter, “but an annual gain in home sales will not occur until 2024,” Yun says. On an annual basis, contract signings are still down 24.1%, coming off the pandemic-fueled homebuying frenzy.

Meanwhile, home prices likely will remain steady in most parts of the country, with a minor change expected in the national median home price, Yun suggests. NAR is forecasting the median existing-home price to moderate after rapid gains over the previous two years. The national median home price is expected to be about $380,100 this year, falling 1.6% compared to the previous year. NAR expects home prices to gain traction again next year, jumping 3.1% to $391,800.

NAR also estimates a 1.3% increase in the median new-home price to $461,000 in 2023, followed by a 2.8% increase in 2024 to $474,000. NAR points to the higher costs of land and construction materials for the projected gains in new-home prices.

All four major regions of the U.S. posted monthly gains in contract signings in January, NAR reports. The West saw the largest increase, followed by the South. “An extra bump occurred in the West because of lower home prices, while gains in the South were due to stronger job growth,” Yun explains.

New-Home Sales Rebound

The pick-up in home sales also was felt in the new-home market last month. The National Association of Home Builders credited builders’ sales incentives—such as mortgage rate buydowns, paying points for buyers or even offering price reductions—for helping bring home buyers back to the market. Fifty-seven percent of builders have reported using incentives to bolster sales, according to NAHB surveys.

“Buyer incentives, along with stabilizing mortgage rates during the month of January, increased the pace of new home sales for the month,” says Alicia Huey, chair of the NAHB. “However, in a sign of current market weakness, sales are down 19.4% compared to a year ago.”

Affordability is still weighing on home buyers. The median price for a new home has fallen for three consecutive months and is down compared to a year ago, says Danushka Nanayakkara-Skillington, the NAHB’s assistant vice president for forecasting and analysis. For the third consecutive month, the median new-home price fell after peaking in October at $496,800. In January, the median price was $427,500, down 8.2% from December.

Home buyers are finding more available inventory in the new-home sector. Completed, ready-to-occupy inventory jumped 115% compared to a year ago, although that comes after particularly low levels in 2022. Ready-to-occupy inventory also only comprises 17% of the total stock of new homes, builders note.

Source: NAR: Melissa Dittmann Tracey